Check out any of the available Canadian casinos, and you’ll see that most, if not all, accept Discover among the cards offered. You’ll find it standing next to giants like AmEx, VISA and MasterCard, and for a good reason. This is one of the oldest card systems launched in the US but available all across the globe, Canada included. It is really convenient to hold and use if you wish to get more value for your money. It is easy to get started with and due to its huge availability, it is one of the most popular cards across Canadian casinos. Why choose to use Discover across online casinos?

Check out any of the available Canadian casinos, and you’ll see that most, if not all, accept Discover among the cards offered. You’ll find it standing next to giants like AmEx, VISA and MasterCard, and for a good reason. This is one of the oldest card systems launched in the US but available all across the globe, Canada included. It is really convenient to hold and use if you wish to get more value for your money. It is easy to get started with and due to its huge availability, it is one of the most popular cards across Canadian casinos. Why choose to use Discover across online casinos?

Top Discover Casinos

About Discover

As introduced, Discover is a card system launched in the US, a long time ago, in 1986, by a company called Discover Financial Services. When the company launched it, its aim was to create a card system that would be the biggest competitor to giants like AmEx, VISA, Diners Club and MasterCard, already available on the financial scene for years. Thanks to the amazing offering and the perks it came with, this card became exactly that, a leading card used by more than 5 million people all across the globe. Even though launched in the States, it is available all over the world, and is particularly popular in Europe, and Canada, too.

Ever since it gained global recognition, the company behind it kept on introducing new functionalities and benefits to it, expanding its offering, and by 2008, it had processed over $100 billion worth of transactions.

What are some of the perks you’d get with it, you must be wondering. Well, first of all, it comes with no annual fees. Secondly, it is incredibly safe, implementing high-end security measures, including merchant codes assigned to all eCommerce sites that support it, attached to every transaction, and SSL encryption to protect all the data exchanged between users. Thirdly, it offers 5% Cashback on any online purchase or payment you make with it, including online casino deposits! That’s how you get more value for your money with it.

But what makes it stand out from the crowd of similar cards, is the fact that you don’t have to have a bank account to use it! Even though it sounds impossible, in fact, to use it, you’d just need to join the company’s own banking platform which handles all your money and transactions. This platform offers modern and smart finance solutions to provide you with the smoothest transactions, even if you’re not a bank account holder. And, using the card, you can cash out money on popular ATMs by the Bank of Montreal, Scotiabank, ICICI Bank, TD bank, CIBC, Cardtronics, Manulife Bank of Canada and several more.

With all of that in mind, it is no wonder the card is embraced by players and online casino operators alike. And why it is so popular across Canadian online casinos. So, if you’re considering using it, keep on reading to find out how to get started with it.

Getting Started with the Solution

Since you won’t need to have a bank account to start using it, you’d need to visit its official website to find out all about the card types offered and start the registration procedure.

Since you won’t need to have a bank account to start using it, you’d need to visit its official website to find out all about the card types offered and start the registration procedure.

When it comes to card types, you have the Travel Card, which is basically self-explanatory, offered to all those travel enthusiasts, offering them 1.5x unlimited miles for every plane booking they make. Then you have the Secured Card, which functions similarly to debit and prepaid cards, that you can load with money, which is pretty convenient for online gambling transactions. The third type is the Students Card, giving students cashbacks and discounts in all kinds of stores, restaurants and gas stations.

And finally, you have the Cashback Card, which has three sub-types. You have the Regular, the NHL and the Gas and Restaurant card, out of which the Regular is the most suited for online gambling purposes, as it gives you 5% on all purchases and payments, including online casino deposits.

Decide on the card type you’d want to use and press the Apply Now button found next to your chosen card type on the website. Enter the needed personal details, such as employment status, home address, full name, total gross income, rent payment and email address. Choose the card design and accept the T&C, and as the final step, press Submit. With that, you’ll have completed the application and all you’d need to do is wait for the card to arrive at your home address. Of course, you’ll get it in an envelope containing the needed PINs and codes to use where applicable.

Depositing and Withdrawing

Once your Discover card arrives on your doorstep, you can start using it immediately. But first, make sure you choose a proper casino to join. Here at casinoreports.ca, you have many Discover casinos at your disposal, including 21Bit Casino, RedAxePlay, Casinex, JeffBet, and SpinzWin Casino, to name a few. Choose the one that suits your tastes and preferences most, and join it.

To make a deposit with Discover, follow these steps:

- Head over to the casino’s Deposit page and look for Discover’s logo.

- Press the logo and wait for the pop-up to appear.

- Enter the needed card details and the 3-digit verification code you received in the envelope the card arrived in.

- Specify how much you’d want to transfer to your online casino balance.

- Confirm the transaction and the money will arrive on your balance in an instant.

The withdrawal procedure is pretty much the same, only you’d need to look for the card on the Withdrawals page this time. You’d need to enter the needed card details again and specify how much you’d want to cash out. As long as the casino has approved your request, you’d need to verify your identity for the money to arrive safely on your card.

Applicable Fees

We said at the beginning that no annual fees are charged by Discover, but you’ll see that interest rates apply, ranging from 3% to 23.2%, depending on the type of card you’ve chosen to use.

Visit its official website to find out which other services you can use as a Canadian player and the fees that come with them. Since the company behind it offers all kinds of services, such as personal, home and student loans and online banking, among others, they all come with different interest rates.

Accepted Currencies

Considering Discover is a global payment solution, a card, it should come as no surprise that it is offered in different currencies across the world.

Canadian dollars are, of course, an option, being among the mainstream currencies available, but so are US dollars, UK pounds, euros and Australian dollars, to name a few.

Coverage

Discover is available across 200 countries and territories globally, Canada included. There are basically no country restrictions when it comes to who can use it.

So, regardless of whether you’re visiting an international casino based somewhere else or a casino based in Canada, you can rest assured that you’ll be able to smoothly use the card for your deposits and withdrawals.

Customer Support

All users outside of the US, you included, have the phone line +1-224-888-777 to call whenever they need Customer Support assistance. But, if you visit the Help page, you will find a separate Card Help Centre, where you’ll find FAQs to find out all the answers to the questions you might have. You also have the company’s US address displayed on this page.

In case you’re experiencing difficulties with your deposits or withdrawals, you’d need to contact your chosen casino’s agents. Canadian casinos offer Support via many solutions, including phone, Live Chat, on-site contact form and email, as well as via social media, so choose the one that suits you most and ask for assistance. They are equipped with the knowledge to get you the answers you need.

Conclusion

Discover is, undoubtedly, a great solution to use as a Canadian player. It is accepted in your country and in 200 other countries and territories globally, so you won’t need to worry about casino acceptance. On that note, hundreds of casinos are offering it, both national and international, so you’ll have a huge choice of sites to consider and join. It is accepted for both deposits and withdrawals, in Canadian dollars, and it offers phone Support. You can cash out money across most ATMs in Canada using the card, and you don’t need a bank account to use it, so why not give it a try

FAQs

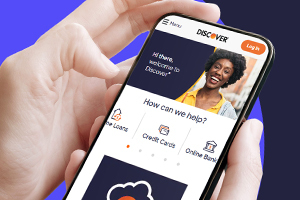

Is there a Discover app I could use?

As a matter of fact, there are two separate, dedicated apps to download, depending on whether you’re an iOS or an Android device user. You’ll find a Quick Link to the Mobile App page on its official website, so make sure you go to the page to download the respective app.

Where can I find Discover on social media?

The solution has profiles on LinkedIn, Instagram, Twitter and Facebook, so you can follow it to keep track of the developments and novelties it introduces.

Is Customer Support available in different languages?

Yes. But, while it is available in different languages if you were hoping for French, we’re sad to inform you that it won’t be an option. The only options are English and Spanish.

Must I apply online for my card or is there another way?

While the online option is the most convenient and the easier way to apply for a card, you can also call the 1-800-347-2683 number and apply for a limited choice of cards, the Business and Secured not included.

Will the solution need my credit score to approve my card?

As a matter of fact, depending on the product, the card you’re applying for, different credit score requirements apply. You’d need to check its official website to figure out which card you’d want to apply for and the score requirement. For instance, Secured cards are for all users who build their credit from scratch, while the It Card is for people with established credit.